Translate this page into:

Mediclaim insurance challenges and solutions – Doctors supporting patients: A Medic LAWgic initiative

*Corresponding author: Dr. Purvish M. Parikh, Group Oncology Director and Professor of Medical Oncology, Shalby Cancer and Research Institute, Ahmedabad, Gujarat, India. purvish1@gmail.com

-

Received: ,

Accepted: ,

How to cite this article: Parikh PM, Bhosale B, Lokeshwar N, Kamath M, Kumar A, Gulia A, et al. Mediclaim insurance challenges and solutions – Doctors supporting patients: A Medic LAWgic initiative. Indian J Med Sci 2019; 71(1): 22-7.

Abstract

Introduction:

Because patients covered by medical insurance are being denied legitimate claims, doctors are working shoulder to shoulder with them and have garnered significant experience in this matter. We, therefore, decided to a systematic survey under the Medic LAWgic banner and presented the data.

Methods:

A short, 8-question multiple-choice survey was conducted online among doctor clinicians. Duplicate replies were removed. The remaining replies were evaluated, interpreted, and the data are being presented here.

Results:

A total of 377 doctors responded. The majority (208, 55%) had faced problems with medical insurance claims in more than 10% of their patients. Almost half of them (48%) had outright rejection of the claims in more than 10% of their patients. Reduction in claim amounts was faced in more than 10% instances by 262 (70%). The five most common causes for refusal or rejection of claims included failure of patient to disclose pre-existing illness (234, 62%), other insurance policy terms related issues (157, 42%), oral medication (199, 53%), treatment without admission (155, 41%), and treatment with new modes of therapy (152, 40%). As many as 301/377 (80%) doctors had written letters to the insurance companies for supporting their patients’ claim. Such supporting letters from the treating doctors resulted in the claim being accepted or approved in 216 instances (57%).

Discussion:

Mediclaim denial is a major and growing problem. People who need financial assistance the most are also the most vulnerable to denial. In the USA, such denial rates ranged from 1% to 45% of in-network claims in the year 2017. Unfortunately, <0.5% of patients appealed such claim denial. The insurance regulatory and development authority of India (IRDA) have issued guidelines that all claims need to be settled within 30 days and that insurance companies must fulfill their contractual commitment for genuine claims, even if timely intimation was not possible. Insurance companies are running a business for profit. Hence, even the most expensive plans will have a list of exclusions, in the fine print. Indian patients need to be proactive in following up when claims are rejected or reduced. Doctors are their pillar of support, whose advantage needs to be taken by them. IRDA and consumer courts are also looking after patients’ rights in this matter.

Conclusion:

Patients are increasingly facing challenge of medical insurance companies denying legitimate claims. Doctors help by writing to the insurance companies supporting their patients claim and such letters help in the majority of instances. Patients and their families need to follow up aggressively when their claims are not approved, rejected or reduced. They should also request the help of their doctors when facing such challenges.

Keywords

Financial implications

Claim rejection

Denial of benefits

Clarification and explanation

Reimbursement

Third-party administrators

INTRODUCTION

There is a rising incidence of patients covered by medical insurance being denied legitimate medical expenses. This has led to a lot of distress for patients’ families and is a cause of concern for all stakeholders. There is a sporadic discussion among doctor groups regarding the various facets of these problems. A few formal discussion sessions have also been conducted at conferences. Doctors have also shared various ways they have helped the genuine patients get their rightful medical expense claim approved. We, therefore, decided to a systematic survey under the Medic LAWgic banner and presented the data.

MATERIALS AND METHODS

We first reviewed the literature on the subject.[1,2] Based on the key important grey areas, we prepared a short, 8-question survey containing multiple-choice type options [read, select, and click - no typing; Table 1]. This was uploaded on Google survey and the link shared with Indian doctors. The request was for all interested doctors to take the survey once and to forward the message within other WhatsApp groups of doctors. Duplicate replies were removed. The remaining replies were evaluated and interpreted with reference to the current situation.

| Q. No. | Question | Type |

|---|---|---|

| 1. | Do you treat patients who have mediclaim insurance | Yes/No |

| 2. | In what instances have you experiences insurance companies refusing cashless approval | One of three options to be selected * |

| 3. | In what instances have you experiences insurance companies rejecting claims | One of three options to be selected * |

| 4. | In what instances have you experiences insurance companies reducing claim amount | One of three options to be selected * |

| 5. | In what instances have you experiences insurance companies asking for clarification or explanation | One of three options to be selected * |

| 6. | What were the problems faced in your practice with insurance companies | Six options provided (to select as many as apply) |

| 7. | Have you written letters to insurance companies supporting your patients’ claims | Yes/No |

| 8. | Did your supporting letter to insurance companies result in a benefit to the patient in terms of acceptance/approval of claim | Yes/No |

RESULTS

After eliminating duplicate replies, we had 377 responses that could be analyzed. Of these, 8 did not deal with mediclaim patients, and 369 doctors did.

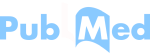

To the question, regarding having to face insurance companies refusing to give cashless approval, 13 had not faced it anytime, 156 (41%) had faced it in <5% of cases and the majority (208, 55%) had faced this in more than 10% of their patients [Figure 1].

- In what instances have you experienced insurance companies refusing to give cashless approval.

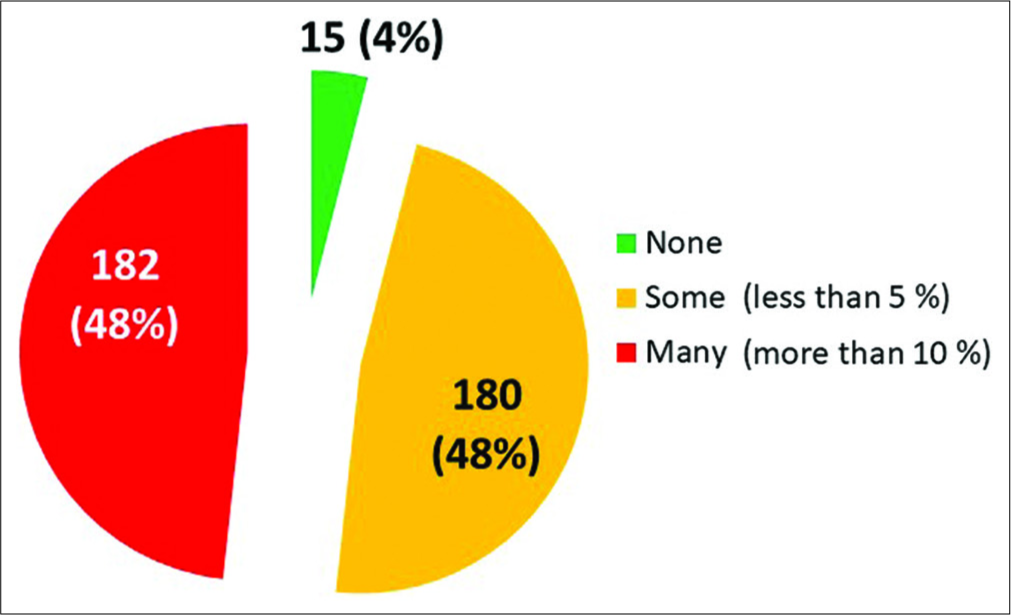

Experience regarding rejection of claims was not faced by 15 doctors. The remaining faced it <5% of time or more than 10% of times in almost equal proportions [47% and 48%, respectively; Figure 2].

- In what instances have you experienced insurance companies rejecting claims.

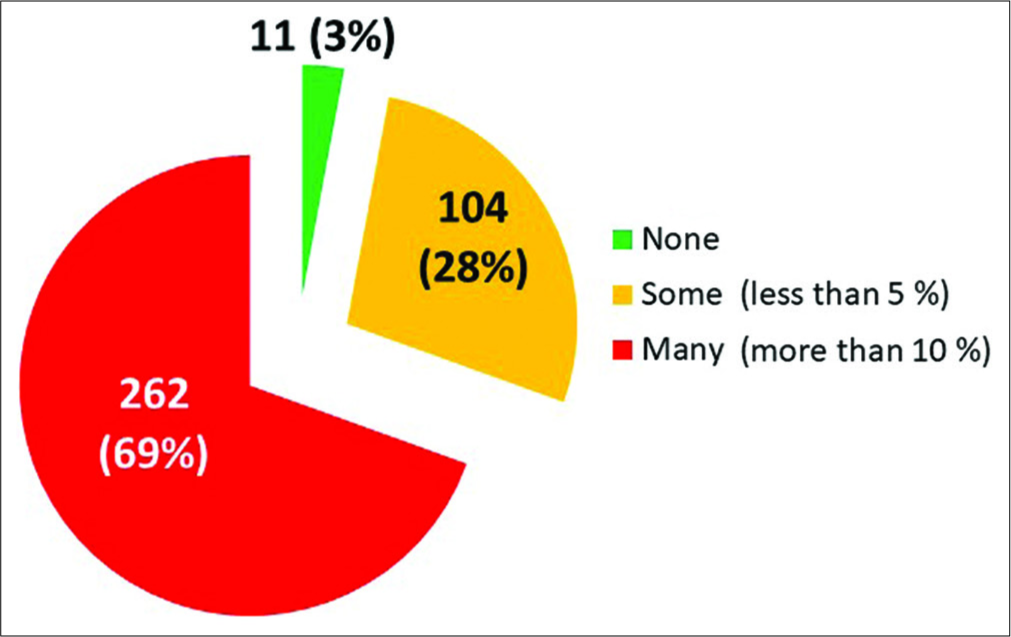

Reduction in claim amounts was a larger problem, faced in more than 10% instances by 262 (70%). It was faced in <5% instances by 104 doctors [28%; Figure 3].

- In what instances have you experienced insurance companies reducing claim amounts.

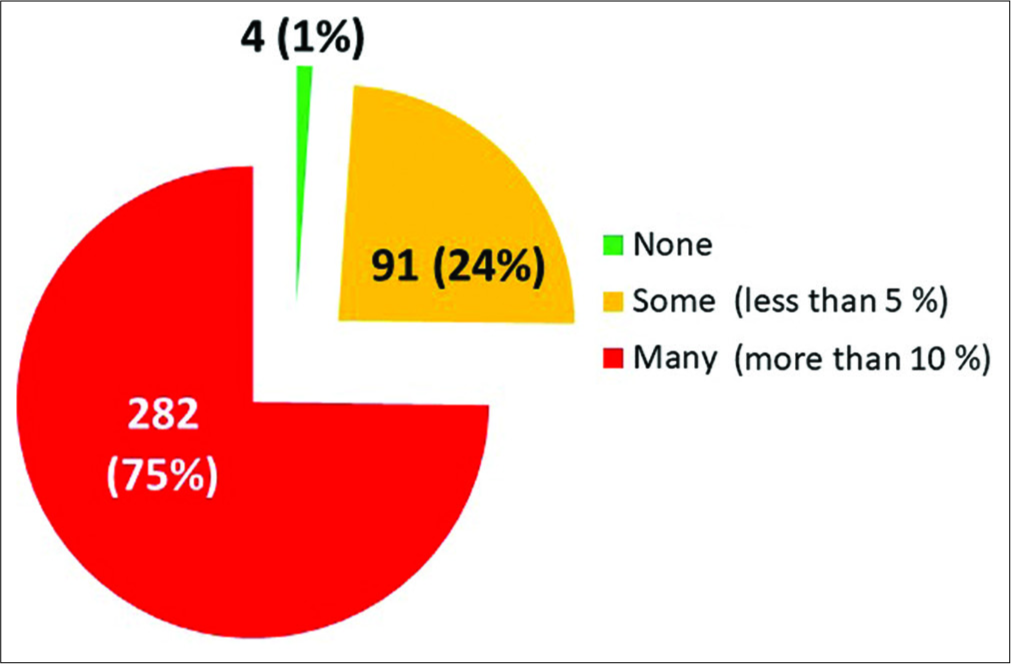

When asked about insurance companies asking for clarification or explanation, this was faced by 282 (75%) in more than 10% of their patients and by 91 (24%) in <5% of instances [Figure 4].

- In what instances have you experienced insurance companies asking for clarifications or explanations.

The five most common causes for refusal or rejection of claims are shown in Figure 5. The largest proportion was due to failure of the patient to disclose pre-existing illness (234, 62%) followed by rejection because of other insurance policy terms related issues (157, 42%). The treatment was given by oral medication (199, 53%), treatment without admission (155, 41%), and treatment with new medication (152, 40%) completed the picture.

- What were the problems/issues related to your patients (select all that apply in your practice).

In an attempt to help their patients, 301 (80%) of doctors had written to the insurance companies supporting the patients’ claim. The remaining 76 were not asked by their patients to provide support.

The supporting letter to the insurance from the treating doctors resulted in claim being accepted or approved in 216 instances (57%) [Figure 6].

- Did your letter to insurance company result in benefit to your patients (insurance claim accepted/approved).

DISCUSSION

Mediclaim denial is a major and growing problem.[2] A Google search, with the words “mediclaim denial” resulted in 69,400 hits (August 23, 2018). After adding the word India (mediclaim denial India), it provided 53,600 hits. Searching for Indian court judgments that related to mediclaim denial led to 936 cases.[1] Finally, the PubMed search using the words “medical insurance claim denial” resulted in access to 52 peer-reviewed and published articles.

People who need financial assistance the most are also the most vulnerable to denial[3] one study consisted of 14,693 antihypertensive prescriptions in the USA involving 164 prescribing physicians and 7061 unique patients.[4] In a total of 2289 (15.6%) instances, medicines were not procured, and this affected 24.3% of concerned patients. This included 1466 (64%) prescriptions being denied by the medical insurance company. Significant factors associated with failure of approval included newly diagnosed hypertension, new antihypertensive drugs, and enrollment in certain medical insurance schemes.

Again, in the USA, transparency data show denial rates ranged from 1% to 45% of in-network claims in the year 2017.[5] Interestingly, consumers rarely appeal against claims denials. For instance, healthcare.gov consumers appealed <0.5% of denied claims, and issuers overturned 14% of appealed denials. Overall data included 232.9 million claims received, and 41.9 million (18%) were denied. The same transparency data for earlier years (2015 and 2016) show an even more dismal appeal rates by consumers, being 0.1% and 0.2%, respectively.

Another publication in the year 2000, from Kaiser Family Foundation, found that the majority of consumers (51%) experienced some problems with their coverage.[6] About half were billing- and paperwork-related issues and about one-third were related to actual care. About 38% of insured ill said they had to pay extra for treatment – with 14% having to shell out of pocket at least $1,000. The process was also so time-consuming that 58% said dealing with insurance companies was more stressful than preparing and filing income tax returns. In these data, 6% filed formal appeals.

In India, the situation is quite similar. The normal policyholder pays his premium every year with the aspiration that all costs related to hospitalization will be covered, and he will not have to face additional financial burden - up to the limit of the sum insured. Unfortunately, many times, the insurer will not settle the claim.[7] The processing of all claims, by the insuring company, falls into four buckets – cashless or reimbursement and network or non-network hospitals. This is usually well known. However, we need to be aware that some insurers even have a blacklist and automatically deny all claims that involve hospitals on that list. The easiest should be cashless facility in a network hospital. However, this may also be denied if information sent by the hospital is insufficient, or the request for pre-authorization is not sent in time.[7] Medicine is not mathematics. Often the symptoms vague, and it might take several investigations to arrive at the right diagnosis. Till this time, the insurer can claim that they are not be able to verify whether the claim is admissible or not. Several patients have had to spend an additional night in the hospital till their claims are processed by the insurance company or third-party administrators (TPA).

In case of a medical emergency, the usual step is to get admitted to the nearest hospital. If this is a non-network hospital, cashless claim will be automatically be denied, and processing will only be on a reimbursement basis. Even in such circumstances, the intimation needs to be sent to insurance companies within 24 h and must include, at least, the following details – policy number, name of the hospitalized insured person, type of illness, date and time in case of an accident.

In case of planned admission for medical treatment, the pre-authorization form needs to be signed by the treating doctor and must contain details about the treatment as well as its expected cost of treatment. All documents need to be original. It is best to get in writing from the insurance company what documents are required by them. In general, the requirement included claim form, discharge summary, doctor’s consultation note, hospitalization and medical bills, payment receipts, and investigation reports. In addition, in case of accidents, there is a need for self-declaration or an FIR. If the hospital is not registered, additional information required will be registration number, number of beds, and availability of doctors and nurses 24/7 – all of which needs to be on the hospital’s letterhead, as well as signed and stamped by the concerned hospital.

While the insurance regulatory and development authority of India (IRDA) have issued guidelines that all claims need to be settled within 30 days, this clock starts from the date of receipt of the last necessary document.[8] Furthermore, the insurer may initiate an investigation before paying the claim. Hence, claim processing is always longer than stated. IRDA has also brought out a circular for insurance companies to ensure that they fulfill their contractual commitment for genuine claims, even if unavoidable circumstances prevented timely intimation.[9]

Our survey documents that the problems faced by patients while receiving their due benefits from their legitimate medical insurance continue unabated, being experienced in their patients by 364/377 (97%) doctors. In fact, in 208/377 (55%), this challenge was seen in more than 10% of their patients [Figure 1] rejection of claims on more than 10% of times of their patients was experienced by 48% of treating doctors [Figure 2]. In fact, reduction in claim amounts was a larger problem, faced in more than 10% instances by 262 [70%, Figure 3].

Insurance companies asking for clarification or explanation was faced by 282 (75%) in more than 10% of their patients [Figure 4]. The common causes for refusal or rejection of claims [Figure 5] included failure of patient to disclose pre- existing illness (234, 62%), other insurance policy terms related issues (157, 42%), treatment with oral medication (199, 53%), treatment without admission (155, 41%), and treatment with new medication (152, 40%).

We need to therefore understand why this happens.[10,11] First of all, insurance companies are running a for profit business, and their primary objective is to make as much profit as possible. They will, therefore, use all possible means to fulfill this goal - often at the cost of the insured patient. No wonder some people have compared full/comprehensive insurance cover to Swiss cheese - full of holes and loopholes. Even the most expensive plans will have a list of exclusions - in fine print. The list of pre-approved medical treatments is also an important finite list. While most patients will know that nonprescription oral medications, cosmetic surgeries, and experimental treatment are not covered. However, the unpleasant surprise comes when standard care as per published guidelines and prescribed by doctors as essential medical management is denied. Those patients with chronic illnesses, who need their insurance most, are likely to be those who are left in the lurch by their insurers. They might have diligently paid their insurance premium for decades and not claimed anything - but once their first admission is on the radar, all subsequent claims are an uphill task. Even if the patient visits his/her doctor in the pre-approved network hospital, all is not above board. There could be specific tests, visiting specialists, etc., not recognized by the insurance company. Moreover, the onus of knowing this is on the unsuspecting patient. Insurance companies pay their staff doctors or TPA a larger sum for all claims rejected as compared to those approved - an incentive to deny legitimate claims. Hence, all insurers usually have an “automatic” policy to reject all high-value claims outright. Most patients do not want to go through the “trouble” of the long fight with the insurers and will, therefore, not dispute the rejection. In the few cases, where the patients and doctors pursue this, they are prompt to blame their deliberate fraud on a computer glitch. For ailments such as cancers, hypertension, diabetes, and renal failure - even when the drug/treatment procedure is covered, the insurer uses another trick. They will delay in urgent cases as much as possible, hoping that the patient will get frustrated and pay himself instead of pursuing with the insurer to get approval. This is especially true in today’s age of the nuclear family when the earning member is ill, and the spouse has to take care of everything else including the kids – time is the essence when claim delayed is the same as claim denied.

The first step is to ensure that the patient’s family does not accept what the insurance company says at face value. Read their reply yourself, respond in an objective manner and ensure that you follow-up as frequently as required. In the USA study, there were 80% incidence of medical bills contain errors (Medical Billing Advocates of America).[12] These include bill coding errors mistakes, duplicate bills, inflated bills (inputs the wrong cost for the item), etc. Hence, patients should go through every bill, read all details, and keep own records for verification. Raise the flag as soon as an error is noticed. This will prevent the insurance company system from taking your patient for granted. Most patients are not aware that they have the right to first know what the insurer is going to pay before making the remaining payment.[13] The patient also has a right to ask for a manual review of the bill and the claim to check for errors. The TPA assigned to your case in the hospital or by the insurance company is paid by them. He is not really working unconditionally for the benefit of patients. So take all recommendations with more than a pinch of salt. Be quick to ask questions and demand an explanation. Like in the consent for medical treatment, so also for mediclaim-related forms, watch out for any blank/unfilled sections. If a form that needs to be signed says “I will be responsible for costs not covered by insurance” be cautious. We would recommend crossing it out and writing specifically, “I will be responsible for costs which are medically necessary, which are not responsibility of my insurer company, are appropriately priced, and for which I am counseled before their use in my treatment, especially when they are not part of standard operation procedures.”

Such insight is used by doctors to help their patients. Among the polled doctors, 301 (80%) had written to the insurance companies supporting the patients’ claim. The remaining 76 did not do so because their patients did not ask for such support. The good news is that the supporting letter to the insurance from the treating doctors resulted in claim being accepted or approved in 216 instances (57%) [Figure 6].

The IRDA and consumer courts also come to the rescue of patients.[9,14] For instance, recently, an insurance company denied claim of a patient who was admitted for pancreatitis on the grounds that he had a habit of consuming alcohol. The consumer court in Chandigarh passed an order that medical insurance cannot be denied just because the patient had consumed alcohol before his admission to the hospital for treatment.[14]

CONCLUSION

There are several aspects that patients need to keep in mind and request the help of their doctors when facing challenges in having their medical insurance claim approved [Table 2].

| S. No. | Message |

|---|---|

| 1. | Patients are increasingly facing challenge of medical insurance companies denying legitimate claims |

| 2. | We used a short 8question online survey to pool the experience of 377 doctor clinicians |

| 3. | 208/377 (55%) had faced problems related to medical insurance claims in more than 10% of their patients |

| 4. | 301/377 (80%) of doctors had written to the insurance companies supporting their patients claim |

| 5. | Doctors’ supporting letters resulted in claim being accepted or approved in 216 instances (57%) |

| 6. | Patients and families need to followup aggressively when their claims are not approved, rejected, or reduced |

| 7. | Doctors, insurance regulatory and development authority of India and courts are supporting legitimate claims from patients covered under medical insurance |

| 8. | The government of India’s Ayushman Bharat scheme is in the right direction to ensure free treatment to the population that needs the most assistance |

Financial support and sponsorship

Nil.

Conflicts of interest

There are no conflicts of interest.

References

- Available from: https://www.indiankanoon.org/search/?formInput=mediclaim+denied [Last accessed on 2019 Feb 02]

- Available from: https://www.ncbi.nlm.nih.gov/pubmed/?term=medical+insurance+claim+denial [Last accessed on 2019 Jun 24]

- Transplant recipients are vulnerable to coverage denial under medicare part D. Am J Transplant. 2018;18:1502-9.

- [CrossRef] [PubMed] [Google Scholar]

- Available from: https://www.kff.org/private-insurance/issue-brief/claims-denials-and-appeals-in-aca-marketplace-plans [Last accessed on 2018 Aug 25]

- Available from: https://www.kff.org/health-costs/news-release-html-format-press-release-20000607a [Last accessed on 2019 May 09]

- Why Your Cashless Health Insurance Claim Could be Denied. Available from: https://www.economictimes.indiatimes.com/wealth/insure/why-your-cashless-health-insurance-claim-could-be-denied/articleshow/61020550.cms?from=mdr [Last accessed on 2019 May 06]

- Available from: http://www.policyholder.gov.in/Rejection_of_Claims.aspx [Last accessed on 2019 Jul 01]

- Available from: http://www.policyholder.gov.in/uploads/CEDocuments/Repudiation%20of%20Claim%20Circular.pdf [Last accessed on 2019 Jul 02]

- Available from: https://www.thehealthy.com/healthcare/health-insurance/health-insurance-secrets [Last accessed on 2018 Sep 07]

- Available from: https://www.patriotcompli.com/post/tricks-insurers-use-to-avoid-paying-claims [Last accessed on 2018 Sep 07]

- Medicare program; medicare hospital insurance (Part A) and medicare supplementary medical insurance (Part B). Notice of CMS ruling. Fed Regist. 2013;78:16614-7.

- [Google Scholar]

- Available from: https://www.timesofindia.indiatimes.com/city/chandigarh/booze-before-hospitalisation-no-ground-for-mediclaim-denial-consumer-court/articleshow/66550350.cms [Last accessed 2018 Nov 14]